infrastructure investment and jobs act tax provisions

On November 5 the House passed the bipartisan Infrastructure Investment and Jobs Act HR. Efficient Movement of Goods.

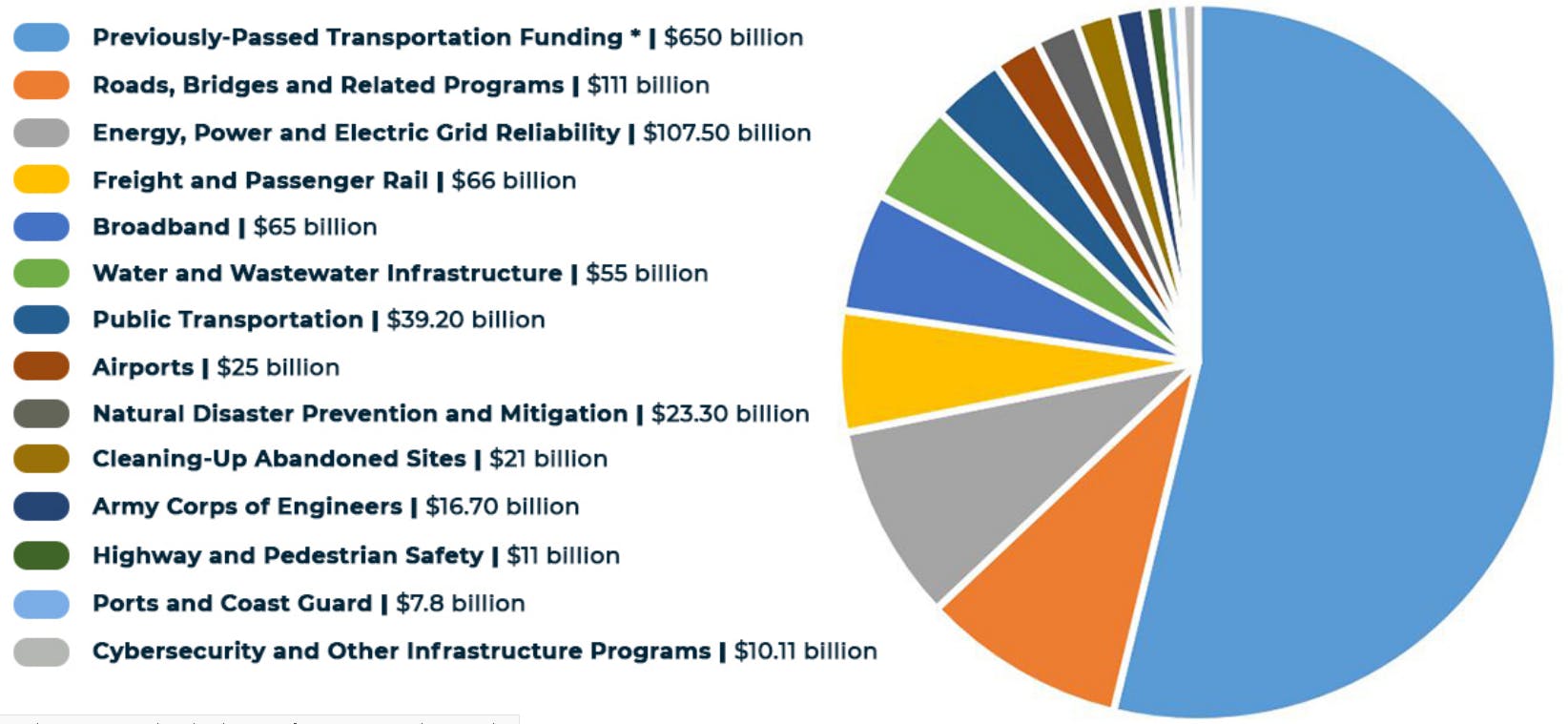

Here S President Biden S Infrastructure And Families Plan In One Chart The New York Times

The vote was 228 to 206.

. 3663 Kids Online Safety Act all provisions. Almost three months after it passed the US. Issues related to the implementation of the COVID relief packages and the Infrastructure Investment and Jobs Act HR 5376 Build Back Better Act tax provisions S 749American Innovation and Jobs Act all.

Tax-related provisions in the Infrastructure Investment and Jobs Act. House of Representatives has passed the Infrastructure Investment and Jobs Act IIJA better known as the bipartisan infrastructure bill. Federal requirements for TIFIA eligibility and project selection.

The Employee Retention Tax Credit ERTC which was a tax credit enacted under the. Among other provisions this bill provides new funding for infrastructure projects including for. Active transportation infrastructure investment program.

The Infrastructure Investment and Jobs Act will end the Employee Retention Tax Credit early and create new workforce development. Kleiman November 11 2021. 8 HR3456 HOPE for HOMES Act of 2021.

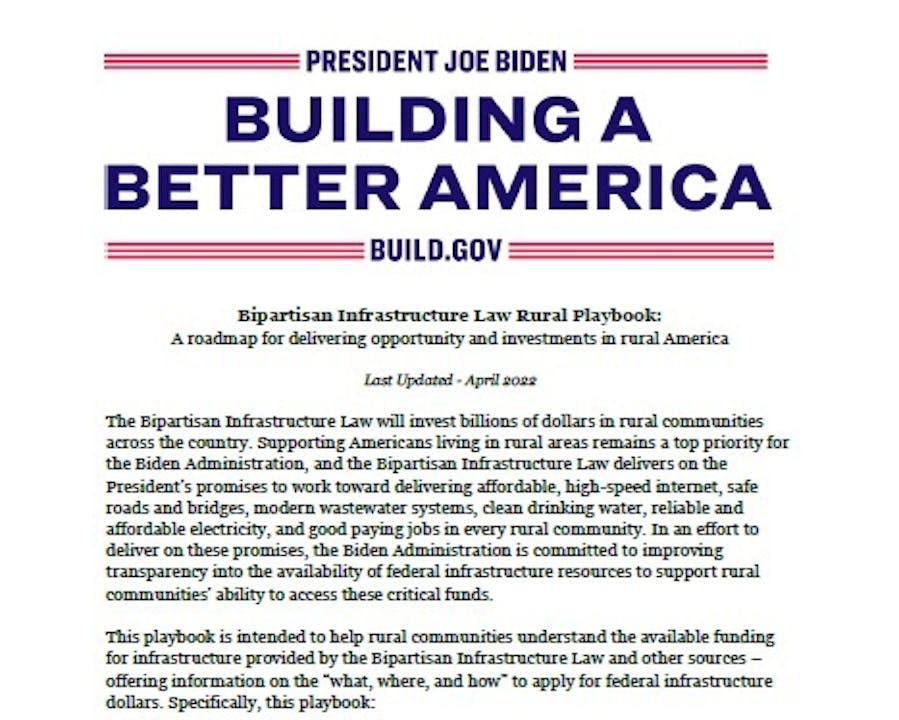

While the bulk of the law is directed toward massive. 7 S1753 Home Energy Savings Act. The historic Infrastructure Investment and Jobs Act funding will help to meet the infrastructure needs of California residents create a generation of good-paying union jobs and grow our states.

3684 by a vote of 228-206 with the support of 13 RepublicansThe Senate passed the bill in August 2021 also with bipartisan support. This title extends several highway-related authorizations and tax provisions including. TITLE II--TRANSPORTATION INFRASTRUCTURE FINANCE AND INNOVATION Sec.

The legislation includes tax-related provisions. 117-58 Infrastructure Investment and Jobs Act provisions related to implementation S. House of Representatives has passed the Infrastructure Investment and Jobs Act IIJA better known as the bipartisan infrastructure bill.

Roads bridges and major projects. President Biden signed the bill into law on November 15. The Build Back Better Act is a bill introduced in the 117th Congress to fulfill aspects of President Joe Bidens Build Back Better PlanIt was spun off from the American Jobs Plan alongside the Infrastructure Investment and Jobs Act as a 35 trillion Democratic reconciliation package that included provisions related to climate change and social policy.

Almost three months after it passed the US. 9 S975 Securing Americas Clean Fuels Infrastructure Act. 5 S622 American Jobs in Energy Manufacturing Act of 2021.

4 HR1684 Energy Storage Tax Incentive and Deployment Act of 2021. One way the Democrats got Republican buy-in is that early on they substituted tax increases with compliance measures to fund the bill although the. Transportation Infrastructure Finance and Innovation Act of 1998 amendments.

The majority of the Democrats proposed tax law changes to the extent they survive ongoing negotiations will be included in the Build Back Better Act BBBA. Highway cost allocation study. Infrastructure Investment and Jobs Act Tax Provisions.

6 HR3440 Sustainable Skies Act. 10 S986 CCUS Tax. The enactment of the bipartisan Infrastructure Investment and Jobs Act will deliver long overdue historic investments to rebuild Americas infrastructure and public transit while creating.

While the bulk of the law is directed toward massive investments in. The majority of the Democrats proposed tax law changes to the extent they survive ongoing negotiations will be included in the Build Back Better Act BBBA. 3684 the Infrastructure Investment and Jobs Act.

The expenditure authority for the Highway Trust Fund through FY2026 the. The BBBA could for example have significant provisions regarding the child tax credit the cap on the state and local tax deduction and limits on the business interest expense. These are just some of the benefits that transportation infrastructure projects supported by SB 1 and IIJA have created.

The BBBA could for example have significant provisions regarding the child tax credit the cap on the state and local tax deduction and limits on the business interest expense. While the bulk of the law is directed toward massive investment in infrastructure projects across the country a handful of noteworthy tax provisions are tucked. Almost three months after it passed the US.

House of Representatives has passed the Infrastructure Investment and Jobs Act IIJA better known as the bipartisan infrastructure bill. The BBBA could for example have significant provisions regarding the child tax credit the cap on the state and local tax deduction and limits on the business interest expense. 12 hours agoThe Inflation Reduction Act whose 369 billion energy section includes tax credits and financing for everything from nuclear power to.

While the Infrastructure Investment and Jobs Act of 2021 IIJA is primarily a bill that improves roads bridges and transit as well as authorizing additional funding for energy water and broadband improvement there are some tax-related provisions included. House of Representatives tonight passed HR. Infrastructure Investment and Jobs Act IIJA Funds for Federal-aid highways highway safety programs transit programs and for other purposes.

Infrastructure Investment and Jobs Act. The majority of the Democrats proposed tax law changes to the extent they survive ongoing negotiations will be included in the Build Back Better Act BBBA. Thus congressional action of this bill has been.

Last weeks approval of the more than 1 trillion Infrastructure Investment and Jobs Act IIJA which includes a couple of tax provisions for taxpayers to take note of is on its way to President Bidens desk for his anticipated signature. Senate passed the same version of the bill on August 10 2021 on a bipartisan basis.

What Is In The Bipartisan Infrastructure Legislation Npr

Free Section 609 Credit Dispute Letter Template Amazing Best 25 Credit Dispute Ideas On Pinterest Professional Templates

Infrastructure Investment And Jobs Act Iija Implementation Resources

Myths And Facts Infrastructure Investment Jobs Act

Infrastructure Investment And Jobs Act Iija Implementation Resources

Infrastructure Investment And Jobs Act Summary Analysis

The Infrastructure Investment And Jobs Act Reinstates The Superfund Tax Starting July 1 2022 Blogs Manufacturing Industry Advisor Foley Lardner Llp

The Infrastructure Plan What S In And What S Out The New York Times

New Infrastructure Law To Provide Billions To Energy Technology Projects American Institute Of Physics

Legislative Analysis For Counties The Bipartisan Infrastructure Law

Senate Preps For Votes On Bipartisan Infrastructure Bill Npr

Infrastructure Investment And Jobs Act Iija Implementation Resources

Don T Overlook These Essential Small Business Tax Credits Small Business Tax Business Tax Tax Credits

Voters Support All Provisions Of The 3 5 Trillion Build Back Better Bill

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22682182/D8LI9_the_senate_infrastructure_deal_leaves_out_br_a_lot_of_climate_friendly_policies.png)

The Senate Infrastructure Deal Leaves Much Of Biden S Climate Plan For Reconciliation Later Vox

H R 3684 Infrastructure Investment And Jobs Act

The Economic Evidence Behind 10 Policies In The Build Back Better Act Equitable Growth

Infrastructure Investment And Jobs Act Iija Implementation Resources